Tax Business Owners - Call 956-695-1952

FREE TRAINING FOR TAX BUSINESS OWNERS, EA's & CPA's

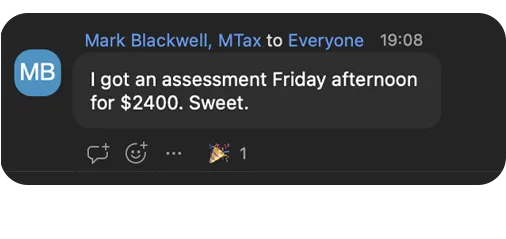

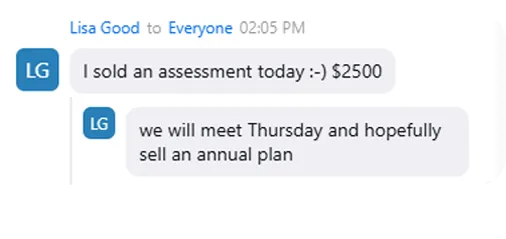

Tired of being buried in 1040s? Discover how to turn the advice you already give away for free into a $2,500+ paid service — without adding more clients or stress.

Join the LIVE Training [Friday, November 14 @ 12 PM PST | 2 PM CST | 3 PM EST]

FREE training starts in...

Here’s the Agenda

How to ATTRACT & Not Chase High Paying Tax Advisory Clients

The Tax Strategies You Can Use & The Shortcut to New Ones

How to Charge $2,000-$20,000 per Tax Advisory Client

Featured On

What You Can Expect From The Training?

Before The Event

Overworked and Underpaid: Struggling with long hours for low-value tax prep clients.

Uncertainty About Advisory Services: Feeling unqualified or unsure how to offer tax advisory without extensive expertise.

Attracting the Wrong Clients: Dealing with clients who undervalue their services and haggle over fees.

Overwhelmed by Complexity: Intimidated by the idea of delivering tax plans or not knowing where to start.

Lack of Confidence in Selling: Hesitant to charge premium prices due to fear of rejection or imposter syndrome.

After Attending the Event

Clarity on High-Value Clients: Understand exactly who your ideal clients are and how to attract them.

Confidence in Offering Advisory Services: Gain a clear framework for delivering tax plans without feeling overwhelmed.

Increased Revenue Potential: Learn how to position yourself for $100K/month by offering strategic advisory services.

A Proven System to Follow: Walk away with a step-by-step blueprint that simplifies your workflow.

Tools for Premium Pricing: Know how to confidently present and charge for your services without hesitation.

Freedom From Overwork: Discover how to serve fewer clients while earning more.

Positioning as a Trusted Advisor: Learn how to become the go-to expert for high-net-worth clients.

Efficiency Through Technology: Get insights on using tools and systems to save time and scale your services.

Immediate Action Steps: Leave with practical, actionable strategies you can implement right away.

Renewed Energy and Focus: Feel empowered and excited about transforming your business and reclaiming your time.

[Friday, November 14 @ 12 PM PST | 2 PM CST | 3 PM EST]

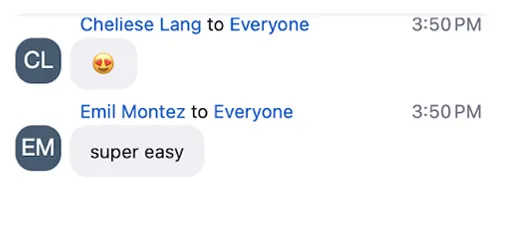

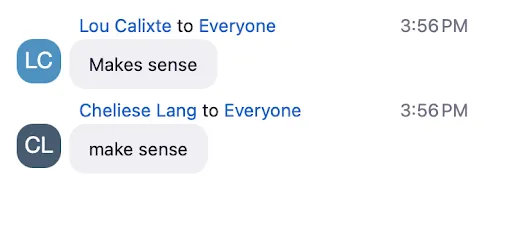

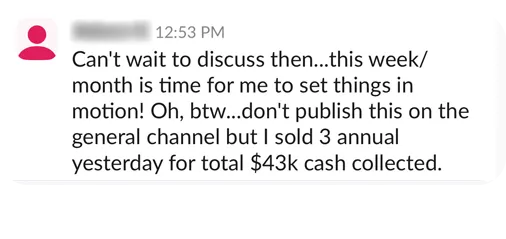

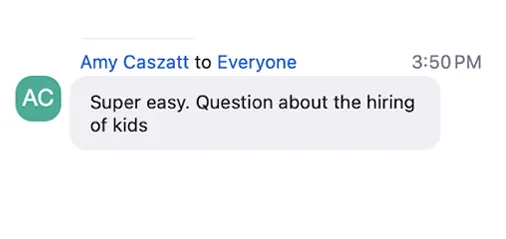

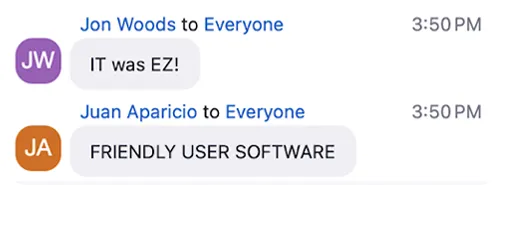

See what REAL PEOPLE with REAL RESULTS

have to say about us.

Turn on Audio

Frequently Asked Questions (FAQs) and Answers

What if I’ve never offered tax advisory services before?

No problem! This event is specifically designed for tax professionals who want to transition into advisory services. We’ll show you how to start even if you’ve only done tax prep before. You don’t need to be an expert in tax planning—we’ll give you a proven framework to follow.

Do I need to know advanced tax strategies to benefit from this event?

Not at all! We focus on simplifying the process so you can deliver high-value results without needing to memorize the tax code or learn advanced strategies. Technology and tools can handle the heavy lifting for you.

How can I attract high-paying clients when I’m already struggling to get clients now?

We’ll show you how to shift your positioning, messaging, and client acquisition strategies to appeal to clients who are willing to pay top dollar for advisory services. It’s about working smarter, not harder.

Will this work if I’m a solo practitioner with no team?

Absolutely! Many tax professionals start as solo practitioners. We’ll show you how to leverage tools and processes to operate efficiently, even without a large team.

What if I’m already too busy with my current workload?

That’s exactly why you need this event! We’ll show you how to restructure your business to focus on fewer clients who pay more, giving you back your time while increasing your income.

Is this event really free?

Yes, it’s completely free to attend. There’s no catch. We want to show you the value of this approach so you can decide if it’s the right fit for your business.

Will I have to invest in expensive software or tools after the event?

No, we’ll introduce you to tools and systems that make advisory services easier, but there’s no obligation to purchase anything. You’ll have the flexibility to choose what works best for your business.

What if I’m not confident in selling high-ticket services?

We get it—selling premium services can feel intimidating. That’s why we’ll cover exactly how to present your value, communicate confidently, and close deals without feeling pushy.

How much can I realistically earn with tax advisory services?

It depends on your effort and implementation, but many tax professionals using our framework have gone from under $5K/month to consistently earning $25K/week by attracting high-value clients.

What if I have questions or need help after the event?

We’ll provide follow-up resources and options to get additional support if you need it. You won’t be left wondering what to do next.

2025 © Tax Maverick - All Rights Reserved

This site is not a part of the Facebook website or Facebook, Inc. Additionally, this site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

In the interest of full disclosure, at the end of the training, I will be offering an opportunity to work directly with me to help you implement the strategies discussed. This is completely optional. While my assistance may shorten your learning curve and improve your results, it is by no means necessary for you to begin implementing what you learn in the training on your own right away.

DISCLAIMER: Your level of success in attaining the results you desire depends on many factors, including (but not limited to) the time you devote to the strategies discussed, your background, experience, and work ethic. The average person who follows any "how to" information gets little to no results. All business entails risk and requires substantial and consistent effort. If you're not willing to accept that, this training is not for you.